Credit Union of America (CUA) takes an active role in our community and prioritizes making a positive impact. This is especially true in the realm of education, given that we were originally started for and by educators. Click the link below to view CUA's 2024 Caring in Action Report outlining our community giving in the form or donations, sponsorships, and time! For assistance in accessing this document, please contact hello@CUofAmerica.com or 800.256.8049.

2024 Giving Summary

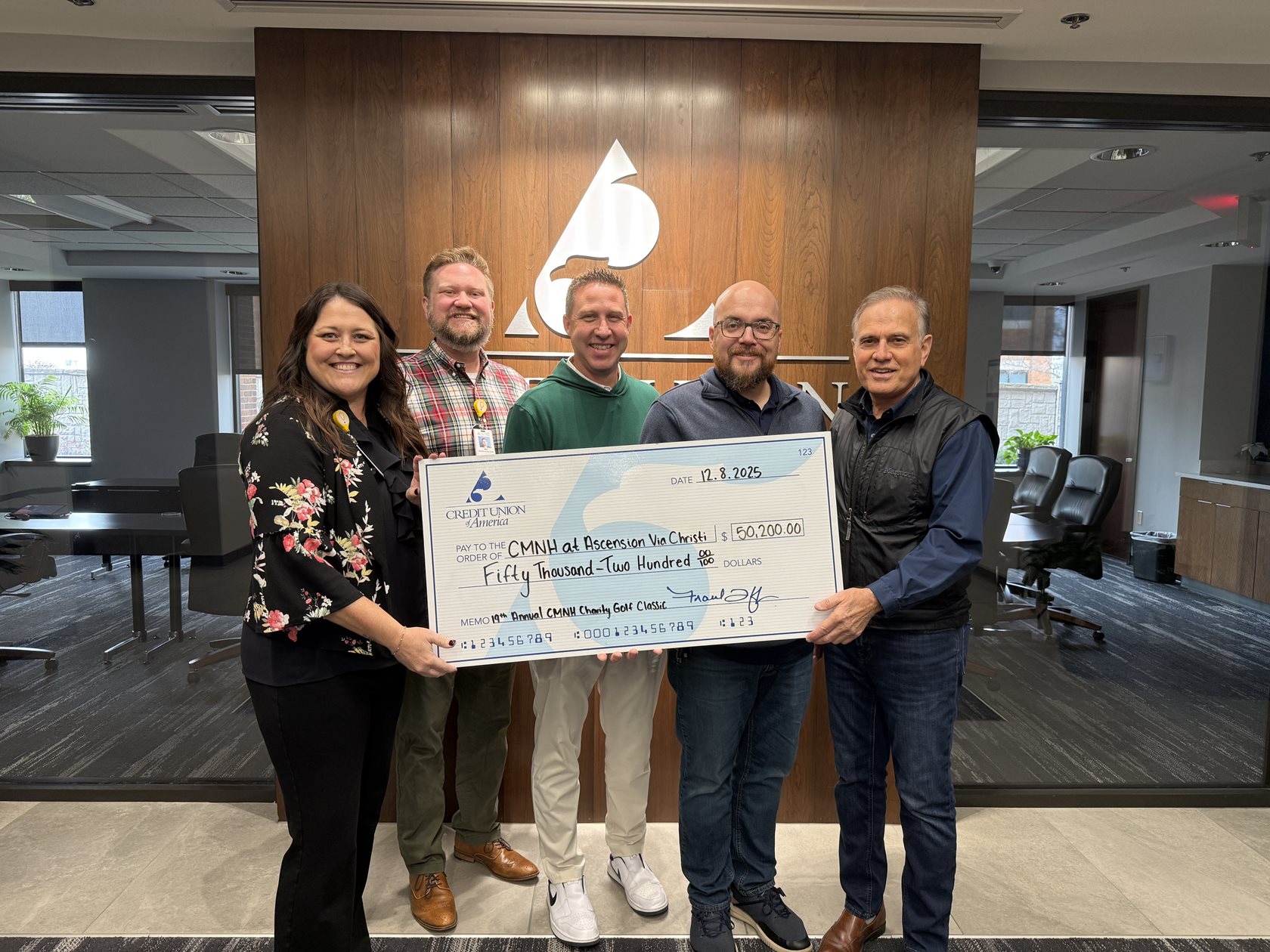

Children’s Miracle Network Hospitals

CUA’s charity of choice is Children’s Miracle Network Hospitals. The program offers financial assistance to Kansas families to help cover medical bills regardless of household income. Major fundraisers include an annual golf tournament and monthly employee jean days.

Interested in participating or sponsoring the annual golf tournament?

Register Now

Project Teacher

Project teacher is the only free teacher resource center in the state of Kansas, and CUA is proud to contribute resources to equip these teachers, empower students, and change our community.

Pando Initiative

Pando Initiative connects with students to help them engage and thrive in school and in their future. CUA volunteers for events like RealityU and Cooking for a Cause to support this wonderful cause.

Requesting Donations

In addition to offering grant money for teachers and scholarship money for students and nurses, CUA supports a variety of charitable and community efforts throughout the year.

If you are looking for a partner in your charitable efforts, tell us a bit about your project or program, and perhaps we will be able to offer you a donation.

Request a Donation